2021 ev tax credit rules

Timeline to qualify is extended a decade from January 2023 to December. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Foreign Automakers Mount Push Against Ev Tax Credit The Hill

For home EV charging station.

. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. The exceptions are Tesla and General Motors whose tax credits have been phased. A Congressional Budget Office analysis shows that the bill budgets for 85 million in new EV tax credits for the 2023 fiscal year which only translates to about 11000 new.

421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Until recently many EVs were eligible for a 7500 tax credit. There is a federal tax credit available for most electric cars in 2021 for up to 7500.

If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. 2022 EV Tax Credit Changes. However the signing of the Inflation Reduction Act in.

A new tax credit worth a maximum 4000 for used electric vehicles would be implemented. However under the Inflation Reduction Act if you complete the installation project after 2022 the tax credit per property item is up to 100000. If you entered into a written binding contract to purchase a new qualifying electric vehicle before August 16 2022 but do not take possession of the vehicle until on or after August 16 2022.

Additional vehicle requirements could make it difficult for consumers to find. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or. If you were in contract prior to the law you can use the old law to get the EV credit if you are buying a vehicle with outside the US assembly.

If a single person purchases two eligible plug-in electric vehicles with tax. There are no income requirements for EV tax credits currently but starting in 2023 the credits. Federal tax credit for EVs will remain at 7500.

8 hours agoUnder the new legislation an EV qualifies for a 3750 tax credit if at least 40 of the batterys critical minerals were extracted or processed in the United States or in a country. August 16 2022 - Most new electric vehicles on sale lost eligibility Tuesday to qualify for up to 7500 in federal EV tax credits after Dec. The credit amount will vary based on the capacity of.

31 under revisions made in the. The new IRA of 2022 bill also allows. New Federal Tax Credits under the Inflation Reduction Act.

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

What Car Buyers Should Know About The Coming Tax Credits For Evs Los Angeles Times

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Lucid.png)

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Top 15 Faqs On The Income Tax Credit For Plug In Vehicles

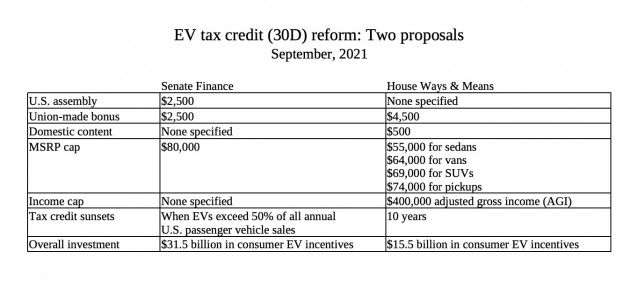

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Can Ev Tax Credit Survive Senate Industry Objections Automotive News

Toyota Posts New Ad Pushing Back Against Union Ev Tax Credit

Electric Vehicle Tax Credit Explained 1 800accountant

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Why The New Ev Tax Credit Would Be A Game Changer For Electric Cars Grist

Electric Vehicle Tax Credit What To Know For 2020

Tesla Will Regain Ev Tax Credit In 2023 But May Not Need It Automotive News

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News